CAMBRIDGE, ON — Travellers can add Allianz Global Assistance to the growing list of insurance providers offering ******** insurance.

The company’s brand new ******** Insurance and Assistance Plan, which is being offered through its national distribution network of over 9,000 travel agency and insurance broker partners, provides up to $1,000,000 in coverage for ********* medical treatment related to ********, along with additional value-added benefits.

The news follows similar coverage plans already announced by Manulife, which launches this month, as well as Blue Cross and B2C provider Medipac back in July. Airlines, tour operators and hotels, including **********, WestJet, Sunwing, Transat, ********** Vacations and Sandals & Beaches Resorts, have also announced ******** insurance plans in recent weeks.

While noting how Global Affairs’ Level 3 travel advisories remain in place, Allianz acknowledges that some Canadians may be required to travel abroad for work or family reasons. Its new plan, which offers coverage for international destinations including the United States, aims to help limit the spread of the ***** by providing financial protection and high-touch assistance services that will encourage travellers to seek medical treatment and follow quarantine protocols if they test positive for ******** while abroad.

“We encourage all Canadians to adhere to Government of Canada advisories and guidelines for international travel. We also recognize that some of our customers may have important reasons to travel in these uncertain times,” said Lucy Hathaway, Chief Sales Officer of Allianz Global Assistance. “For those individuals, we remain committed to helping protect their health and safety by ensuring our customers have access to coverage for ********* medical, quarantine and other costs related to ******** while abroad.”

Hathaway added: “Our hope is to remove barriers that might otherwise lead a traveller to avoid seeking treatment, which will hopefully help to limit the spread of the ***** at a destination while ensuring their health fully recovers before returning to Canada.”

Allianz’s plan is available for purchase on a standalone basis and provides benefits for ********-related treatment and expenses only, making it an ideal complement to its standard ********* Hospital Medical and All-Inclusive plans. The ******** Insurance and Assistance Plan can also be purchased to supplement other standard out-of-country medical plans that may limit coverage for ********.

The plan does not have an age limit and is available for trip durations up to the applicable provincial health insurance coverage out-of-country day limit. No medical questionnaire is required to purchase the plan, however, customers who have previously tested positive for ******** must receive a negative test result before their departure from Canada to be eligible for coverage. Customers must also have shown no signs or symptoms of ******** in the 14 days prior to their date of departure from Canada.

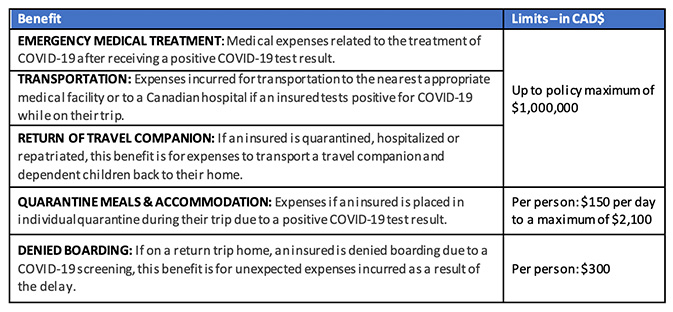

High-level benefits of the new plan include, but are not limited to, the following:

For more information email newbusiness@allianz-assistance.ca.